Government Announces Significant Increase in Duty-Free Thresholds for Imported Goods and Personal Items

The Jamaican government has pledged to double the duty-free threshold for both imported goods at ports and personal items carried through airports.

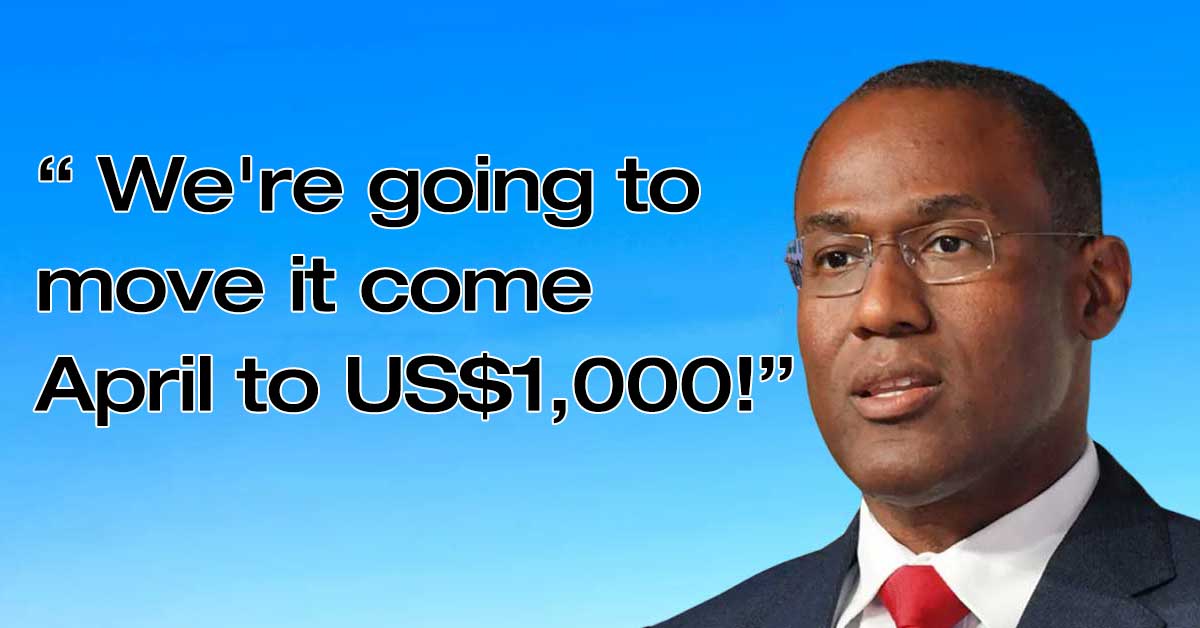

The announcement was made by the Minister of Finance and the Public Service, Dr. Nigel Clarke, during the 80th staging of the Jamaica Labour Party (JLP) annual conference at the National Arena on Sunday.

Under the proposed changes, the duty-free threshold for imported goods is set to increase from US$50 to US$100, while the limit for personal items taken in at the airport during travel will rise from US$500 to US$1,000.

Dr. Clarke assured enthusiastic party supporters that this initiative is part of a broader effort to streamline and modernise the customs structure.

Currently, according to the Jamaica Customs Agency (JCA), goods with a free onboard value of US$50 imported through a courier agency attract applicable customs charges.

Additionally, arriving passengers, aged 18 and older, are allowed a duty-free allowance of US$500 for personal and household goods.

Items exceeding this limit may be subject to customs charges calculated on the excess value.

Dr. Clarke acknowledged the challenges faced by arriving passengers in the current customs process, describing it as “tedious” and promising relief.

“When you come to di airport, everybody bother you, wha you buy abroad, you buy dis and you buy dat, ah badda you, ah stop you and mek a line long…we are going to address the threshold. When you enter the airport, it was US$500, we’re going to move it come April to US$1,000,” he declared.

The Finance Minister’s announcement came as he reviewed the economic achievements of the JLP-led Government over the past eight years and outlined future plans.

The proposed changes are expected to have a positive impact on both travellers and the importation of goods, fostering a more efficient and traveler-friendly customs experience.

Remember to share this article on Facebook and other Social Media Platforms. To submit your own articles or to advertise with us please send us an EMAIL at: [email protected]