Great reasons to NOT Raise Taxes in Jamaica

“Read my lips, No new taxes”.

These words sound familiar? Our esteemed Minister of Finance laid down those beautiful words to our precious Jamaican ears knowing that we would receive them gratefully.

Jamaicans are so heavily taxed by our efforts to pass a series of tests from the IMF that the Minister is at a loss of what to do.

If the Minister of Finance believes that we can make it out alive by being billions of dollars in debt then we will just have to faith in his faith.

Believe it or not, the income tax rate in Jamaica used to be 58% in 1979. By 1990 the Income tax rates fell to 33%, then further down the line to what we know it today at 25%.

That is just simply unbelievable to me as I thought it was relatively high compared to other Caribbean countries.

Here are some great Reasons not to raise Taxes.

Decreases Government Revenue

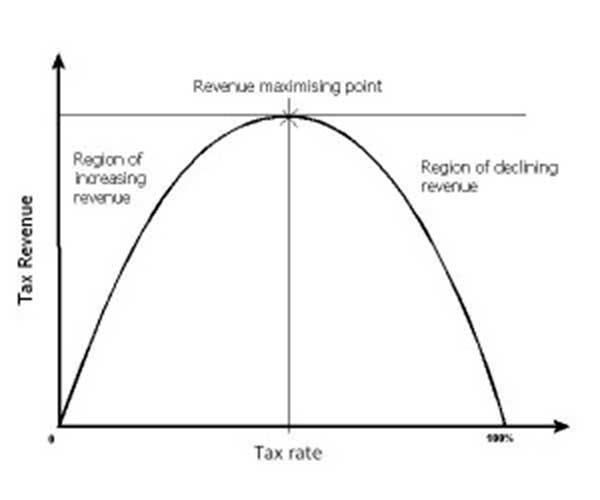

People believe that the relationship between tax levels and government revenues is one that is directly proportional, meaning that if you increase tax rates, government revenue will increase. Looking something like this graph:

Now, let us test that assumption. If you paid 100% in taxes, would you work? I don’t think so. Working would be pointless. So the government would collect $0 from taxes. With that said, the curve must look something like this:

The highest point on the curve is called the revenue maximizing point. This is where the government can collect maximum revenue at the optimum tax rate. If taxes go above that optimal tax level, then the government will start losing revenues. This optimal tax level was found to be about 33% according to studies by Christine and David Romer, two economic professors at the University of California, Berkeley.

Becomes a form of punishment

When tax rates are low people are more willing to pay taxes as they see it as a form of contribution to the society. Everyone agrees that we should pay taxes as these are what drive the country and keep it intact. When taxes rates are high, it leads people to believe that taxes are a form of punishment for being productive. So now, people start to become reluctant in paying taxes as they do not feel they are contributing anymore.

Increased activities of tax avoidance and evasion

People with really high incomes are always looking for ways to reduce the amount of taxes the government takes from their hard earned money. What happens when people who do not have high incomes start to find ways to reduce the amount of taxes they pay? Well, this can be done through two ways; Tax Avoidance which is legally lessening the amount of taxes you pay, and Tax Evasion, illegally lessening the amount of taxes you pay *like not paying taxes*. If the government increases tax rates then there will be an increase in these activities so that people can keep more of what they traded the sweat and blood for.

Increases levels of poverty

Increasing taxes simply increases the levels of poverty as people get to keep less and less of what they worked for. If they can work hard enough to make a certain amount of money to cover their bills and other monthly expenses then they will suffer thus increasing the levels of poverty. Less money to families means the less they are able to take care of themselves.

Check out more from Ryoma by visiting his website HERE:

If you like this article please consider joining our Forum HERE to help us grow.

Remember to share this article on Facebook and other Social Media Platforms. To submit your own articles please send us an EMAIL at: [email protected]. Subscribe to our mailing list to get new articles sent to you automatically.